NAVIGATION

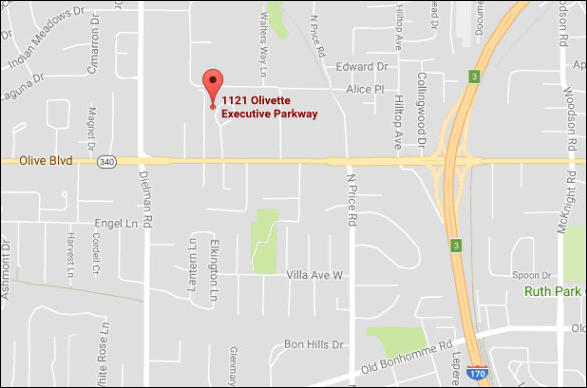

ADDRESS

1121 Olivette Executive Parkway

Ste 200

St. Louis, MO 63132

CONTACT

Info@thetolicenter.com

Tele: (314) 997-6233

About

George P. Whitelaw, III Mr. Whitelaw is a Director and the Chief Executive Officer of the TOLI Center. He received his B.A. degree from St. Lawrence University in 1972. He spent 10 years in commercial banking specializing with closely held corporations. In 1986, he co-founded a closely-held insurance sales and consulting company and managed its executive and employee benefits practice until June, 1998. In 1992, Mr. Whitelaw co-founded Custom Administration Services Company, a privately held TOLI administration support company. In 2000, he founded TrustBuilder Services, LLC, a successor TOLI administration support company. In 2007 he co-founded The TOLI Center, LLC. In 2012, TrustBuilder Services, LLC was merged into The TOLI Center, LLC. Christopher G. Whitelaw Mr. Whitelaw is a Director and Administration Manager of The TOLI Center. He attended Miami University and University of Missouri-St. Louis. He has 14+ years experience in the insurance industry specializing in Life and Health insurance administration and servicing corporate and personal trustees of Irrevocable Life Insurance Trusts. He also currently serves as an Administration Manager of The TOLI Center. Kenneth D. Jackson Ken Jackson is the Director of Administration Services. His primary role is the daily management of operations and coordination of client services. His background in advanced estate and trust planning provides our clients with valuable insight into the policy service issues fiduciaries face in today's changing financial services environment. Ken received his Bachelors degree from Southern Illinois University in 1986 and double majored in Finance and Marketing. In 1995 he received two Masters degree programs from The American College in Bryn Mawr, Pennsylvania, the Masters in Financial Services (MSFS) and the Masters in Management (MSM). Ken holds multiple professional designations. .Services

TOLI Administration Support Services: Credible in-force TOLI policy management requires access to annual policy values and carrier illustrations. Illustration credibility was clarified in 1992 by the Society of Actuaries and Society of Financial Service Professionals and subsequently by FINRA (Financial Industry Regulatory Authority). For non-guaranteed death benefit policies, carrier illustrations depict how a policy works but disclaim predictive value, do not evaluate premium adequacy and do not assess the reasonableness of carrier-controlled assumptions. As a result, premium adequacy and policy performance reporting for non-guaranteed death benefit policies should include annual inforce carrier illustrations and benchmark modeling that use impartial and objective data.

The TOLI Center is the risk identification and mitigation standard for objective, third-

party support services for Trust-Owned Life Insurance (TOLI) policies. The TOLI Center

brings together fee-based TOLI procedures consulting, and policy and portfolio

administration services to support best practice TOLI risk management determinations.

Our clients are corporate and personal trustees and estate planning professionals who

lack the life insurance and regulatory compliance expertise to make informed TOLI

product suitability determinations and monitor policy performance. Our services are

designed to safeguard the interests of all trust parties; trustees, grantors, beneficiaries,

and professional advisors.

The TOLI Center has served trustees since 1992 and can assist TOLI fiduciaries in

evaluating vendor selection criteria, development of TOLI portfolio and compliance

procedures, design and implementation of a TOLI policy management system, and annual

performance monitoring of TOLI Policies.

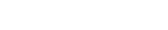

ILIT Management Database (IMD): The IMD is our custom software application licensed to clients to manage ILIT accounts and

TOLI policies. Each IMD is customized as either (1) an intranet application that resides on the client’s private network or (2) a data

center encrypted application accessed by client staff with site administration provided by The TOLI Center.

•

Custom Designed for each client to include the necessary ILIT and TOLI management

functions for their ILIT environment.

•

Clients can license just the software application and are not required to outsource

annual TOLI policy reviews or commit to any other TOLI support services; however, we

offer an array of TOLI support services to supplement a client’s internal ILIT and TOLI

administration capabilities.

•

IMDs are licensed at a low-cost annual fixed fee with no user or TOLI policy volume fees.

Contact Us

Contact us to review your TOLI administration needs. We can provide sample

reports and topical TOLI information and a username and password to test our

ILIT Manaegment Database.

Articles

Articles and Publications 2022 TOLI Portfolio Statistics The TOLI Center: June, 2022 A Lapsing Life Insurance Policy Crisis Trust & Estates E Randolph Whitelaw, AEP and George P Whitelaw: August, 2018 The Lapsing Policy Crisis and Credible Policy Evaluation E Randolph Whitelaw, AEP and George P Whitelaw: March, 2018 ILIT Management Roles, Responsibilities and Checklist The TOLI Center: December, 2016 The Life Insurance Policy Crisis- The Advisor’s and trustee’s Guide to Managing Risks and Avoiding a Client Crisis ABA Flagship Series September, 2016

Policy Remediation: TOLI policy risk management should not be confused with customary life insurance marketing and policy

service practices. A lapsed TOLI policy can lead to questions of trustee negligence and damages. Currently, 17% of all in-force TOLI

policies serviced by The TOLI Center are projected to lapse prior to or within 5 years of the insured’s life expectancy. Several options are

available to clients to address their underperforming policies.

•

Policy Management Alternatives Report. This report includes detailed policy management alternatives for

underperforming policies or policies that are no longer appropriate to meet trust objectives.

•

Life Settlement Market Value Projection. Life Settlement is the sale of an in-force life insurance policy to a third-

party for its fair market value yielding a cash payment to the seller in excess of the policy’s cash surrender value

but less than its death benefit. The purchaser acquires policy ownership, becomes the beneficiary, and is

responsible for future premium payments

o

The sale of a life insurance policy involves the collection of insured medical records to obtain life expectancy

reports, obtaining current policy values and illustrations, and the solicitation of bids. This can be a several

month process.

o

Before considering Life Settlement, The TOLI Center clients can request a Market Value Projection of the

sale of a TOLI policy based on general life settlement eligibility criteria. There is no fee for this service, no

need for insured medical records and no obligation to sell a policy.

Trustees use the Policy Management Alternatives Report and Life Settlement Market Value Projection to review underperforming policy

options with trust parties before commiting to surrender, lapse or sale.

Copyright 2024 The TOLI Center, LLC